Steve (the hubby) is the brains behind our finances. Trust me, before I met him — my finances were a mess. Before we got married, Steve got me to use this budget. WOOT! My hubs is pretty money savvy — and as a result, we have no credit card debt. We have our mortgage and my school loans and thankfully, we can breathe easy! We are blessed. As many are facing difficult times (financially speaking), we never want to take for granted all that we have. We are sharing this with you to encourage and inspire you. So, without further ado, I’ll let my hubby do the talking.

Tips for Organizing Your Finances

Introduction

Let me first start by saying how blessed we are that God has provided for us so generously. At the very least, we try to respect this by being responsible with what He has given us.

This is not a post to help you get out of debt. Maybe the concepts could eventually get to that point, but the purpose of this post is to explain how we organize and manage our expenses within the confines of a budget.

You could probably accomplish the same concept using one bank account and three books (as I’m sure the professional accountants do), but I like doing it this way. I’ve been doing it for over 20 years with small tweaks along the way, so it has stood the test of time – for me at least.

Step 1: Get a Monthly Budget

The foundation of any sound plan is putting together a budget. For income, we get paid bi-weekly, so at a minimum – and predictably – we get two paychecks a month. That is what we use as our monthly budget income. As for expenses, they obviously have to be equal to or less than the income.

Those who get paid bi-weekly have two months in the year where there is an additional pay period. We do not factor that into our monthly budget. That “extra” paycheck goes toward projects, other expenses outside monthly reoccurring charges as needed, or in a savings account.

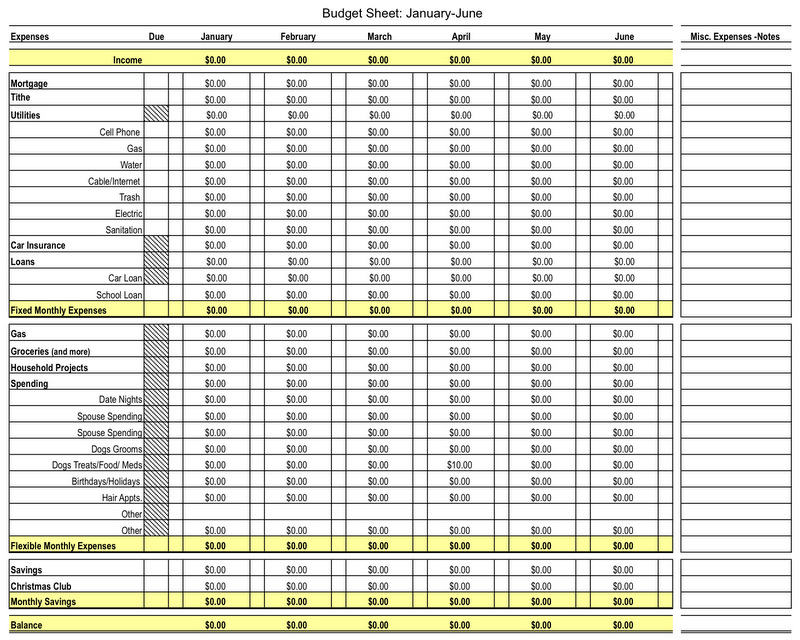

Here is the budget sheet we use.

There are two sheets within the document. One is January-June, the other is July-December. You can customize this to fit within your expenses and the mathematics are all in place, ready to calculate for you! **PLEASE NOTE: You’ll need to DOWNLOAD a copy, this one cannot be edited. Go to File then Download As and once it’s on your computer, you’ll be able to edit.

Step 2: Get a Month Ahead of Your Expenses

Probably the most challenging thing to accomplish is getting enough money to be at least one month ahead of your expenses so you’ll have some breathing room. Gone will be the “living paycheck to paycheck” anxieties that come when a bill is due before your next check.

The idea behind this is to have your monthly budget income available before the beginning of the month. The current months income will be used for next month’s budget.

I did this about 25 years ago by taking out a loan equal to my monthly expenses and never looked back; you may already have that set aside in a savings account; or you may have to put aside a small amount every month and get there over time.

Step 3: Open the Accounts

Our monthly budget process uses three bank accounts, listed below by function. They are:

- Direct Deposits

- Monthly Expenses

- Credit Cards

All paychecks get deposited into the Direct Deposits account which is the holding account for our monthly income for the next month. The Monthly Expenses account is our day to day operating account for the current month. And the Credit Cards is another holding account for credit card charges.

Step 4: The Cash Flow Process

Here is how the process works. To help explain the process more clearly, we will use the months June, July and August, assume a monthly budget of $1000, and a bi-weekly paycheck of $500.

At the end of June, the beginning balances of your accounts will be as follows:

- Direct Deposits: $1000 (equal to your monthly budget)

- Monthly Expenses: $0.00

- Credit Cards: $0.00

To prepare for July’s expenses, you would transfer your monthly budget amount from the Direct Deposits account to the Monthly Expenses account. This will leave account balances as follows:

- Direct Deposits: $0.00

- Monthly Expenses: $1000

- Credit Cards: $0.00

During the month of July, you paid rent, cable, and phone for a total of $500. You also bought $100 worth of stuff on credit card. Your total outflow from your Monthly Expenses account was $600. Of that amount, $500 was debited and you transferred the $100 credit card charge to the Credit Cards account. Doing this transfer reinforces the notion that, like checks and debit cards, credit cards are another method of payment and not an extension of income. Your account balances are now:

- Direct Deposits: $0.00

- Monthly Expenses: $400

- Credit Cards: $100

July 13 comes and your paycheck is deposited in to your Direct Deposits account. Your balances are now:

- Direct Deposits: $500

- Monthly Expenses: $400

- Credit Cards: $100

You pay more bills totaling $300 and buy something else on credit card for $100. Your total outflow was $400. Again, of that amount, $300 was debited, and you transferred the $100 credit card charge to the Credit Cards account.

When July 27 rolls around and another $500 paycheck is deposited in to the Direct Deposits account. You balances now are:

- Direct Deposits: $1000

- Monthly Expenses: $0.00

- Credit Cards: $200

Your credit card bill comes, and it is for $200. You pay it from the Credit Cards account – in full. No minimum payments, finance charges, or interest. Your balances are now:

- Direct Deposits: $1000

- Monthly Expenses: $0.00

- Credit Cards: $0.00

July winds down and you prepare for August by transferring $1000 from Direct Deposits money to Monthly Expenses account and the cycle begins again.

—————

Sooooo, there you have it? Confused? Inspired? Please feel free to send us any questions. We will gladly assist in clarifying any of this information. I can assure you that this budgeting system is a blessing in keeping your finances on track.. Challenge yourself to at least give it a try, and let me know what you think {wink}. Better yet, do you have any tips to share?

Elena says

This is a fantastic post! It’s very similar to what I’ve been drafting myself! I haven’t finished my spreadsheet so I haven’t been able to post it yet! These are great tips! Not many people are debt free but the hubby and I are debt free too! It’s such a great feeling!

Kelly says

Hi Elena! Yes, it is a GREAT feeling 🙂 Good for you — have a fabulous week! Hugs.

Megan says

Great tips!! Megan

Kelly says

Thanks, Megan! Hugs.

Karen Whitney says

This is awesome! Thanks for the spreadsheet!!! I have been working on budgeting since I read the post about the family of 4 living on 14,000. I am also reading Americas Cheapest Family. Everyone says make a budget but they don’t give you a sample or anything. You give us the tools to actually do it! Thank you. I feel like I can now go from mess to success 🙂

Kelly says

Awww, you are so welcome. I would love to hear how the spreadsheet works out for you! Best of luck. Hugs!

Allison @ The Golden Sycamore says

Thanks for this post! I have wanted to budget forever and I start and stop because it’s just too hard for us as a family. I am going to try your method and hope that it can work for us. It seems quite simple and easy to follow…we just need to provide the motivation and self-control! Haha!

Kelly says

Hi Allison! Thanks so much for taking advantage of this spreadsheet and our tips. Keep me posted on how it goes… HUGS!

noni says

I would love to be on a budget and not live paycheck to paycheck. The problem is that my husband has his own company and its either feast or famine with us. Any advice for that? Thanks so much!

Kelly says

Yikes! I can’t say that we do…. but if and when you have some extra cash — put it away. Every little bit adds up 🙂 Wishing you the very best! Hugs.

michelle says

nice spreadsheet! and oh how i wish i could pay my rent with $500!!

i used to do all of my budgeting in xcel but i would always end up days or weeks behind simply because i would always forget about the purchase by the time i was able to get on my computer. i’d end up having to log a whole week’s purchases all at once and then realize at the end that i overspent. i decided to try the ixpensit app for my iphone and it has been so amazing! you can set up different accounts, make different categories for your purchases, and then you can export all your data into excel or as a pdf. but the best part is that you can log your purchases immediately on your phone and see the impact on your budget.

when i was budgeting in xcel, seeing how much money i was spending or how much money was left in my budget was something i was only really ‘aware’ of when i was looking at my spreadsheet. now with the app, i can check and see exactly how much money i have left in my budget while i’m out at the grocery store or shopping. it has really helped me curb my spending and stay within my budget and is probably the best app i have ever purchased!

my boyfriend and i aren’t in debt but we were basically spending all of our paychecks as soon as we got them. now we know exactly how much we are spending and we’re saving money too!

michelle

ps i am in no way affiliated with ixpensit 🙂

Kelly says

I’m not sure there are too many paying $500 for rent — that was an extremely low-ball example 🙂 I’ll certainly share this tip about ixpensit with my hubby. Thanks for stopping by. Hugs!

Trina @ afewmineradjustments.blogspot.com says

This is awesome! Thank you! I make a budget for each month, but never thought to put it all on one page. Love it.

Kelly says

You are most certainly welcome 🙂 Thanks so much for stopping by! Have a lovely weekend.

Debra @ September Acres says

This is great! We do a pretty strict budget although it’s a bit different from yours. I also have a spreadsheet but yours is much prettier! 🙂 I like the idea of paying this month’s bills w/ last months income – brilliant! Thanks for sharing.

Kelly says

Thanks so much, Debra! This system works so well for us and being a month ahead puts your mind at ease. Have a fantastic weekend. Hugs.

Christine says

This is a great post Kelly!! My hubby is really into finances… and I’m going to show him your post!

Thanks so much for sharing this at The DIY Dreamer.. From Dream To Reality!

Kelly says

Thanks, Christine! This system rocks our world 🙂 Have a fabulous weekend. HUGS!

Laura@live-love-scrap says

wow-great tips! thanks!

Kelly says

Thanks so much, Laura 🙂 Have a fabulous weekend. xo, Kelly

Bonnie and Trish @ Uncommon says

Fantastic post Kelly!! 🙂 A Big thank you for the hubs sharing his wealth of info with us!!

Cathy@My1929Charmer says

This was a very good post. My hubs and I have worked hard on not having any credit cards. It took a while to eliminate our debt, but it was so worth it. We only have a mortgage payment, our cars we keep well over 10years, and save, save, save. Thanks to you hubs! My hubs doesn’t even know where the check book is! Thanks for sharing your creative inspiration with Sunday’s Best – it helped to make make the party a success!

Kelly says

Cathy! Good for you… eliminating debt is so liberating 🙂 Thanks so much for stopping by. Have a lovely week. Hugs.

Susan says

Thanks for the spread sheet. I hope it will help us with our budget!

Kelly says

You are so very welcome!! It’s been such a lifesaver for us. Wishing you all the best. Hugs.

Erin says

Great tips. Thanks for share.

Kelly says

Thanks so much, Erin. Have a fabulous day. Hugs.